- How To Money

- Posts

- Tax Deductions, "Rewarding" Loyalty, and Cable on the Rise 📺

Tax Deductions, "Rewarding" Loyalty, and Cable on the Rise 📺

From tax deductions to tasty trends, here’s how to make your money work harder.

Good morning, and happy Tuesday!

This isn’t just any Tuesday. Today is National Chocolate-Covered Anything Day! 🍫

Yes, we said anything. Get creative! Yes, we all love chocolate-covered strawberries and pretzels, but what about chocolate-covered pickles? Corn on the cob? We’ll never know if it’s good until we try it… But we’re hoping one of YOU might try it and report back. 😅

TAX SEASON

Good Deeds & Smart Deductions 🤓

‘Tis the season for giving… and wondering if your generous heart might score a tax reduction. Good news: Some charitable donations are tax-deductible. Less-good news: You only get that perk if you itemize your deductions.

For most people, taking the standard deduction is the best bet. Let’s break it down:

The Standard Deduction Is Kind of a Big Deal 🙌

In 2025, the standard deduction clocks in at:

$15,750 for single filers

$23,625 for heads of household

$31,500 for married couples filing jointly

If your total itemized deductions (think: mortgage interest + state/local taxes + medical expenses + charitable donations) don’t add up to more than those numbers… itemizing doesn’t make sense. And if you don’t itemize, you can’t deduct charitable donations.

So Who Should Itemize? 🤔

Most people stick with the standard deduction because it’s bigger, simpler, and doesn’t require keeping a shoebox of receipts. But itemizing might make sense if:

You have a large mortgage with chunky interest payments

You live in a high-tax state and pay significant state/local taxes

You made major charitable donations (we’re talking big-ticket generosity, not just dropping off a pile of old clothes at Goodwill)

You’ve racked up large medical or dental expenses for the year

If the combo of these stacks up past the standard deduction amount, itemizing is worth the effort because you stand to reduce your tax bill.

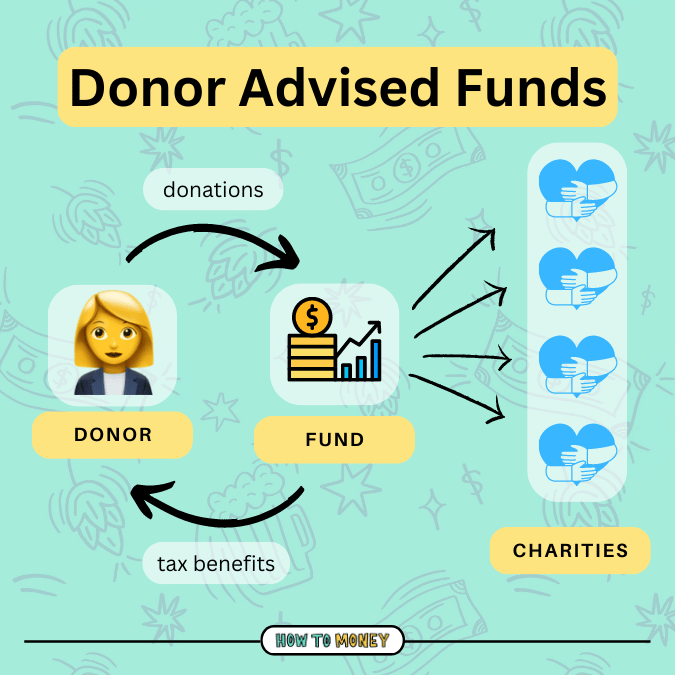

Another option that can help you give effectively is a Donor Advised Fund (DAF). A donor-advised fund lets you donate money or assets now, get the tax deduction right away, and decide later where to funnel those donations. Meanwhile, your contribution can be invested and grow tax-free until you’re ready to give.

Why people like DAFs: Flexibility in timing, potential tax benefits (especially if you donate appreciated assets), and the chance to grow your charitable dollars over time.

Things to keep in mind: DAFs often come with fees, investment choices can be limited, and donations are permanent — once the money goes in, it has to go to charity.

For folks who want to be strategic with their giving or “bunch” donations into one tax year, a DAF can be a powerful tool. Otherwise, simple direct giving still does the job beautifully.

A Heads-Up for 2026 🚨

Starting in 2026, even people who don’t itemize can deduct a little bit, up to $1,000 if you’re single or $2,000 if you’re married. It’s a nice bonus, but still not a replacement for itemizing if you’re trying to deduct major donations.

We’re always in favor of giving back to your community and those organizations you support. Whether or not you’ll get a tax break is a different story… but that shouldn’t be the main focus of giving. 💛

LIFESTYLE

Does Loyalty Work Both Ways? 🔄

On paper, loyalty programs sound like the ultimate cheat code: swipe a card, scan an app, rack up points, get free stuff. Easy. A win-win.

But here’s the uncomfortable truth: a lot of these programs aren’t actually rewarding loyalty — they’re monetizing it. And in some cases, the more loyal you are, the worse the deals get.

When “rewards” quietly stop rewarding you. ✋

Many companies now treat loyalty programs as their own personal data labs. Every latte you buy, every grocery item you toss into your cart, every tap or scroll inside the app becomes part of a profile about you: How often you shop. What you buy. How price-sensitive you are. Even when you’re most likely to say “eh, fine” and pay full price.

And once a company thinks it has you figured out, it can start showing you fewer deals.

This is the new frontier of pricing: individualized discounts powered by algorithms that calculate what you personally are willing to tolerate. Your friend might get a 40% off deal while you get nothing… all because the system decided you don’t need convincing.

Same product. Same company. Totally different price tags.

Consumer Reports just found that Instacart is doing the same thing by using algorithmic pricing to quietly push prices higher on individual shoppers.

So what’s the move? 🤔

To be clear: loyalty programs can still offer real value. But that value depends on you staying in control, not the algorithm.

A few smart rules of thumb:

Rotate where you shop. Don’t give any one company a perfect profile of your habits. The more loyal you are to specific brands and stores, the more likely you are to overpay.

Chase the deals, not the points. A discount today is worth more than a theoretical freebie next month.

Opt out of optional cookies. You may be used to hitting “Accept” when apps or websites ask if you’re OK with tracking, but you don’t need to! Rejecting cookies and hitting “ask not to track” is perfectly acceptable.

Because at the end of the day, loyalty programs aren’t just a question of privacy, they’re a question of price. And if you’re not paying attention, you might be “earning rewards” while quietly spending more than ever.

TOGETHER WITH FACET*

Financial Planning Made Simple ✍️

Your money should be working harder for you — and Facet helps make that happen.

With 1:1 guidance from CFP® professionals, an easy-to-use dashboard, and unlimited messaging, Facet gives you a smarter way to plan for the life you actually want. And with a flat membership fee, you always know what you’re paying for.

If you’re ready to make a real plan (not just cross your fingers and hope), check out Facet and see how good your money can really get.

LIFESTYLE

Buy Now, Pay Later… Worry Sooner 😬

Buy Now, Pay Later (BNPL) apps have basically become the unofficial sponsor of holiday shopping. Klarna, Afterpay, Affirm… they all ask the same thing: why pay today when you can split it into four?

But while BNPL might feel painless in the moment, it can quietly wreak havoc on your budget, and now, even your credit score. With FICO beginning to factor BNPL behavior into scoring models, those “I’ll deal with it later” installments suddenly matter a whole lot more.

At first glance, these apps feel harmless: split a purchase into a few payments, pay a little today, and walk away with the shiny thing now.

Easy. Painless. Too painless, actually.

Why BNPL Can Become a Problem

It encourages buying things you can’t actually afford. Spreading out payments can make a $200 purchase feel like a $50 decision. But if every purchasing decision feels like that, you’re likely to buy more than you otherwise would, which is exactly how people end up overspending without realizing it.

Late payments hit harder than you think. Miss a due date, and you may not just be facing late fees. Many BNPL companies report missed payments to credit bureaus, but not the on-time ones, so there’s no upside for doing everything right, only penalties for messing up once.

Overspending is extremely common. Studies repeatedly show many BNPL users end up behind on payments (and it’s not just people struggling financially). Even high earners can get caught in the “pay later” trap.

We love a good deal, but not at the expense of your future stability.

If you can’t afford it today, you shouldn’t be financing it for tomorrow. Especially when we’re talking about discretionary stuff: clothes, gadgets, holiday decor, yet another kitchen gadget TikTok told you to buy.

BNPL makes impulse shopping easier, but that doesn’t make it smarter. The real flex is buying things you can truly afford with money you already have.

CONSUMER TRENDS

The Comeback Kid 📺

In a plot twist no one saw coming, cable TV is starting to show a pulse again. For the first time since 2017, the TV world added new subscribers instead of losing them.

But the surprising rise isn’t happening because people suddenly missed Comcast’s incredible customer service 😂. It’s happening because streaming prices are rising at a rapid clip. Plus, cable companies finally did something smart: They started bundling live TV with the streaming apps people already use.

A big chunk of that growth came from the rise of “skinny bundles” — live TV streamers like YouTube TV, Sling, and Hulu + Live TV.

Instead of forcing you to pick between “old cable” and “new streaming,” providers are merging the two. Companies like Charter kicked off deals with major content owners, allowing cable customers to get streaming services wrapped into their subscription, and it’s working. Their customer losses have slowed dramatically.

Also, football season helps inflate cable’s numbers. Live sports remain the one thing streaming hasn’t totally cracked, so fans tend to flock back to cable or cable-adjacent options every Fall.

When you bundle the live sports people want with the streaming platforms they’re already paying for? Suddenly, cable doesn’t look like a dinosaur anymore.

But cable is still an expensive line item in your budget. No matter what, it’s important to make sure you're not paying for more than you actually use. If you bring the cord back in your life for football season, set a reminder to cancel it come February. ⏰

ICYMI

Your Weekly Update…

Small Luxuries Are In 😋

McCormick crowned black currant its 2026 “Flavor of the Year,” tapping into a growing trend of Americans seeking small luxuries in a tight economy. As more people cook at home, rich, elevated flavors like black currant are becoming an affordable way to add a little spice (pun intended) to everyday meals.

A Limp Labor Market 💼

Job openings were essentially flat in October at 7.7 million, but the details tell a softer story: layoffs climbed to their highest level since early 2023, and fewer workers felt confident enough to quit.

Snag a $300 Bonus on Chase Freedom Unlimited 💳

For a limited time, you can snag a $300 bonus when you open a Chase Freedom Unlimited card and spend $500 in the first 3 months. (HTM receives a commission if you sign up for a credit card)

That’s all for this week! If you try a weird chocolate concoction today, please do let us know. 😉