- How To Money

- Posts

- Store Brand Surprises, Boring Workday Challenges, and Slaying Your 401k 📈

Store Brand Surprises, Boring Workday Challenges, and Slaying Your 401k 📈

Goooooood morning y’all! 🌞 A quick challenge that’s pretty much guaranteed to make even the most boring work day better...

Goooooood morning y’all! 🌞

A quick challenge that’s pretty much guaranteed to make even the most boring work day better.

Infuse your water with something tasty (like cucumber or fruit!)

Bring something cozy from home to wear (fuzzy socks or a favorite hoodie)

Give out 3 genuine compliments

Listen to a new audiobook or podcast on your drive

Enjoy a midday walk at lunch

Perform 3/5 of these tasks to complete the challenge and kick today’s butt. 😎

Now let’s talk about money! 💰

TO DO

Buy Only Store Brands For a Week 🛒

One of the fastest ways to completely slash your grocery budget is to swap out name-brand products for store-brand products. In fact, by making this small change, you can expect to save around 40% on your grocery bill! 🤯

And to further blow your mind, some generic brand products are manufactured by the same companies that make your favorite name-brand ones. For example, Aldi’s generic version of Cinnamon Toast Crunch is made by General Mills.

While not every generic product is going to hit the same as your name-brand favorites, you won’t ever know unless you try them.

Our challenge to you this week: Buy all generic groceries for a week. Then, see if there are any products worth swapping out for cheaper alternatives going forward.

RETIREMENT

Average 401k Savings Increase 📈

Good news for all the money nerds out there - 401k savings are on the up and up! 🎉

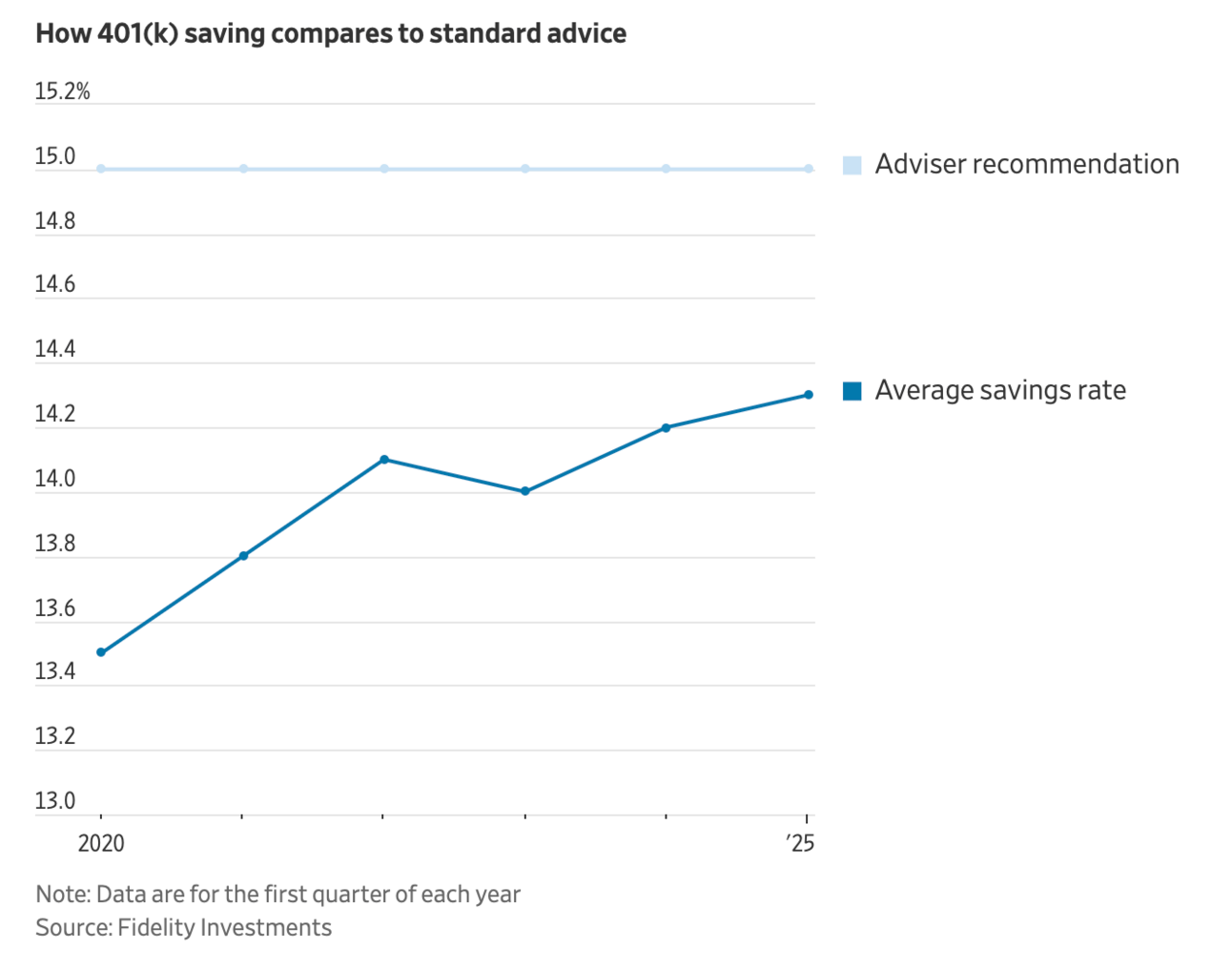

While most workers still aren’t reaching the recommended 15% retirement savings rate, 401k savings rates have risen from 13.5% in 2020 to a record high of 14.3%. We’re big fans of this news. Hopefully, this trend continues!

“But 14.3% is less than a percent more than 13.5%. What’s the big deal?”

Now, now, don’t be so quick to knock the power of incremental improvements. While it may sound negligible, that 1% can have a massive impact on your retirement nest egg.

For example, if you make $70,000 annually and invest 13.5% of your income each year, you’ll be left with a nest egg of about $1,628,000 after 35 years, assuming an 8% return. However, if you bump that up to 14.5%, you’ll reap an additional $121,000. Thanks to that seemingly insignificant 1% difference, you’ll have over a hundred thousand extra dollars to enjoy! A 1% increase is more significant than it seems.

🔑The Key Takeaways:

🏆 Small Increases = Big Wins - If you can increase your retirement contributions by just half a percent, you’ll barely feel it in your budget. However, when compounded over time, that small contribution bump will add up to something much larger. Challenge yourself to keep nudging your retirement contribution higher and higher each year.

⬆️ Increase Your Automatic Enrollment Percentage - Many companies are now automatically enrolling their employees into their 401k contribution plans at a rate of 5%. While this is an awesome step in the right direction, 5% just won’t cut it. So, if you’ve been automatically enrolled at work, make sure to increase your contribution amount sooner rather than later.

💰Take Advantage of that 401k Match - Many employers offer a 401k match, meaning that they will put money into your retirement accounts up to a certain amount if you also contribute. This is FREE money, so make sure to take full advantage of it if you can.

💻 There Are Other Options Available - Not all workers have access to 401k plans, especially those who are freelancers and gig workers. But that doesn’t mean you get a free pass to skimp on your retirement savings. You’d only be doing harm to yourself! Roth IRAs, Traditional IRAs, and Solo 401ks are some great account options for you.

🤑 Make Sure Your Money Is Invested - A massive mistake would be to not invest the money you put into your account. Remember, even though the money is automatically being contributed, you still need to log into your investment account to make sure those dollars are working on your behalf. Index funds are a top-notch choice.

Remember, specific retirement needs will vary. While a 15% savings goal is a solid place to start, you may need more or less money to retire, depending on your other financial choices and desired retirement lifestyle. When in doubt, use any of these 3 strategies to figure out how much money YOU need to retire!

TOGETHER WITH CIT**

Your Bank Doesn’t Deserve You 💔

It’s no secret that your traditional bank isn’t good enough for you. Between useless fees, stagnant interest rates, and crappy customer service, it’s time you break up with your bank.

CIT Bank knows that you deserve better. That’s why they offer 4.00% APY on balances of over $5,000 in their platinum savings account, with no monthly service fees. Plus, their mobile app makes account management a total breeze.

So, if you’d like to start earning over 10x the national average on your savings, check out CIT Bank!

ICYMI

Here’s the scoop…

Booking One-Way Flights? Not So Hot Right Now… ✈️

While some travel experts have urged folks to book separate one-way flights for added flexibility and better prices in the past, one-way flight penalties have reared their ugly heads. According to Thrifty Traveler, 50.1% of domestic one-way flights were priced higher per segment.

Enticing Elon 💰

Elon Musk was just awarded an “interim award” of 96 million Tesla shares, valued at around $23.7 billion, reportedly to keep him “focused and engaged.” This follows the court's blocking of his prior larger stock-option grant. Come to think of it, I’m having a little trouble focusing on my work today… Matt?👀

Ohio Fair Unclaimed Funds

At an Ohio state fair, over $1,200 Ohioans were reunited with over $633,000 of unclaimed funds. The fair booth was able to find folks an average claim of $527.35. Way to go, Ohio!

This serves as a great reminder to check and see if YOU have any missing money…

Remember friends,

Keep your vibes high and your Roth balance higher! 😎

Best friends out 🍻