- How To Money

- Posts

- Shopping Secondhand, Ditching Inconvenient Tech, and Keeping Your Car Happy 🚗

Shopping Secondhand, Ditching Inconvenient Tech, and Keeping Your Car Happy 🚗

Sometimes the older, simpler way of things is not only the most convenient, but the best for your budget.

Happy Tuesday, everyone!

We hope those of you who had MLK Jr. Day off enjoyed the long weekend, whether that meant traveling, tackling a to-do list, or doing absolutely nothing at all (a valid choice).

Consider this your soft re-entry into the week… we know you couldn’t wait. 😉

REAL ESTATE

What’s Up with Mortgage Rates? 🏠

Mortgage rates have had quite the ride over the past few years — rising quickly, then easing just enough to get everyone checking the headlines again. While rates have come down from recent highs, don’t expect a dramatic drop back to the ultra-low levels of the past.

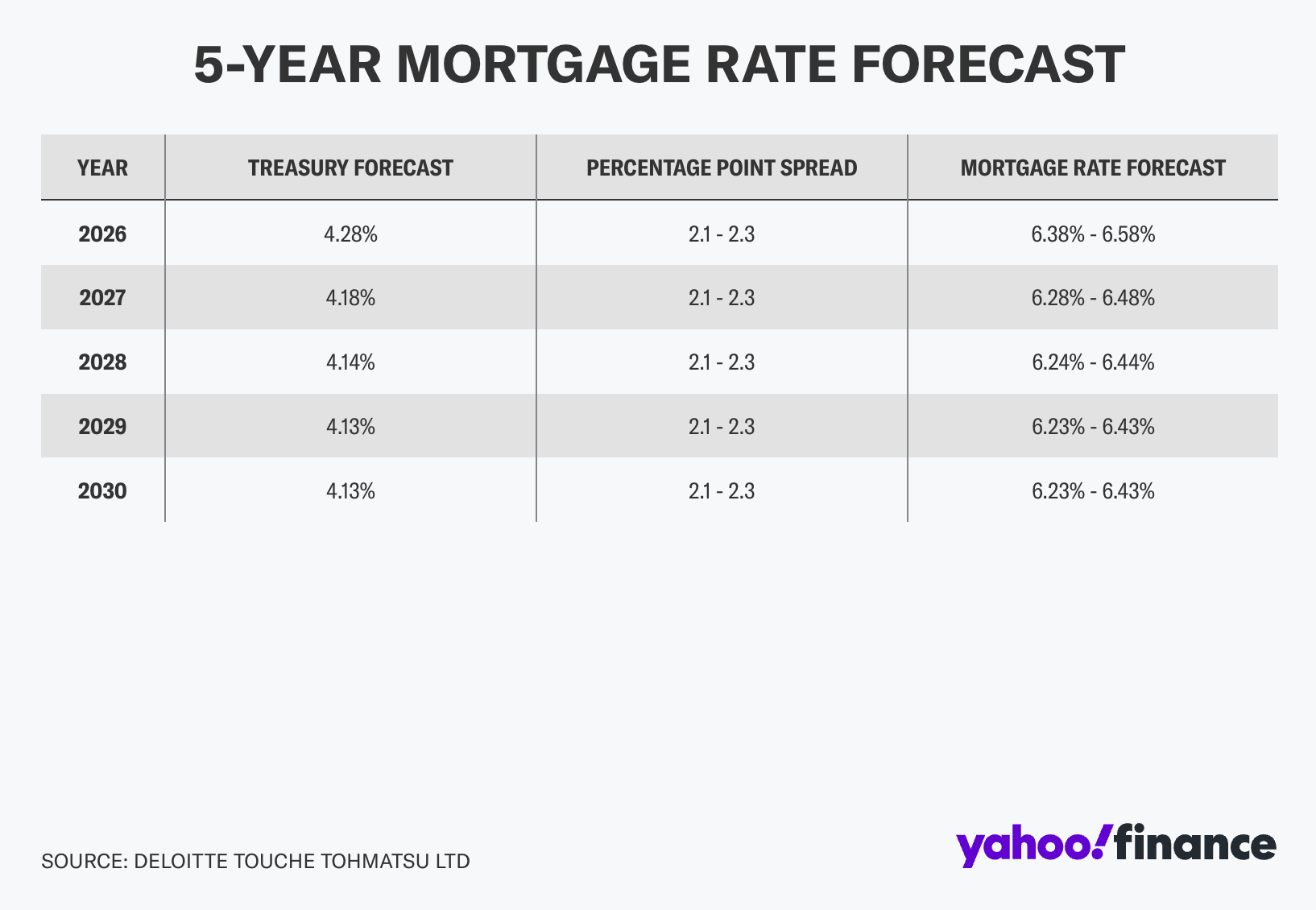

So… what’s the forecast? 🌦️

Most economists expect mortgage rates to stay fairly steady over the next several years, with small ups and downs along the way. Here’s the big-picture view:

Short-term: Despite the desires of many wannabe homeowners, modest movement is possible, but no sharp declines are expected.

Next few years: Rates are projected to land around the low-to-mid-6% range.

Long-term: Experts don’t see rates falling dramatically through the end of the decade.

Mortgage rates tend to follow long-term government bond yields, which are expected to remain elevated. So while rates may wiggle, they’re unlikely to nosedive.

Of course, forecasts aren’t guarantees. Economic shifts, policy changes, or major global events can always rewrite the script (we’ve all seen that movie before).

But what it does mean is that waiting for the “perfect” rate could mean sitting on the sidelines longer than you’d like. Instead, focus on what you can control: your budget, your savings rate, your credit, and how a payment fits into your everyday life.

The smartest financial move isn’t about timing the market and waiting for rates to drop… it’s about choosing what helps you feel confident, comfortable, and in control.

LIFESTYLE

Buy Used. Spend Smarter. 🧠

Once upon a time, buying secondhand was all about saving money. Now? It’s about getting better stuff…and still paying less!!

More people are skipping brand-new and opting for pre-owned. From furniture and fashion to books, gifts, and home goods, secondhand has officially entered the chat. Your local thrift store is cool again - even if we never thought it went out of style.

Why Secondhand is Winning Right Now

A few big shifts are driving the trend:

📉 Quality has gone downhill: Many new items are mass-produced quickly and cheaply, even from brands that used to be reliable. Older items (like my mid-century dresser) were often comprised of higher quality material & built to last.

📈 Prices have gone up: New doesn’t always mean better; it just means more expensive. The thrill of the hunt can be more fun buying secondhand too.

🌎 It’s easier on the planet: Buying secondhand keeps perfectly good items out of landfills and reduces the demand for fast, disposable products.

🗝️ Secondhand has character: Vintage and pre-owned items come with history, charm, and a bespoke quality you won’t find on a big-box shelf.

What to Buy Secondhand

If you’re just getting started, this is where secondhand really shines:

🪑 Furniture (especially solid wood pieces).

👖 Clothing, coats, and denim.

📚 Books, vinyl, and decor.

🍴 Kitchenware and small appliances.

There are also things we would avoid buying secondhand due to hygienic reasons (such as mattresses and pillows…or undergarments).

Buying secondhand isn’t about settling for less; it’s about spending intentionally. When you choose quality over newness, your money stretches further, your purchases last longer, and your budget gets a little breathing room.

Next time you need something “new”, first try searching Facebook Marketplace, hitting up your local thrift stores, or asking friends & family if they’re getting rid of anything!

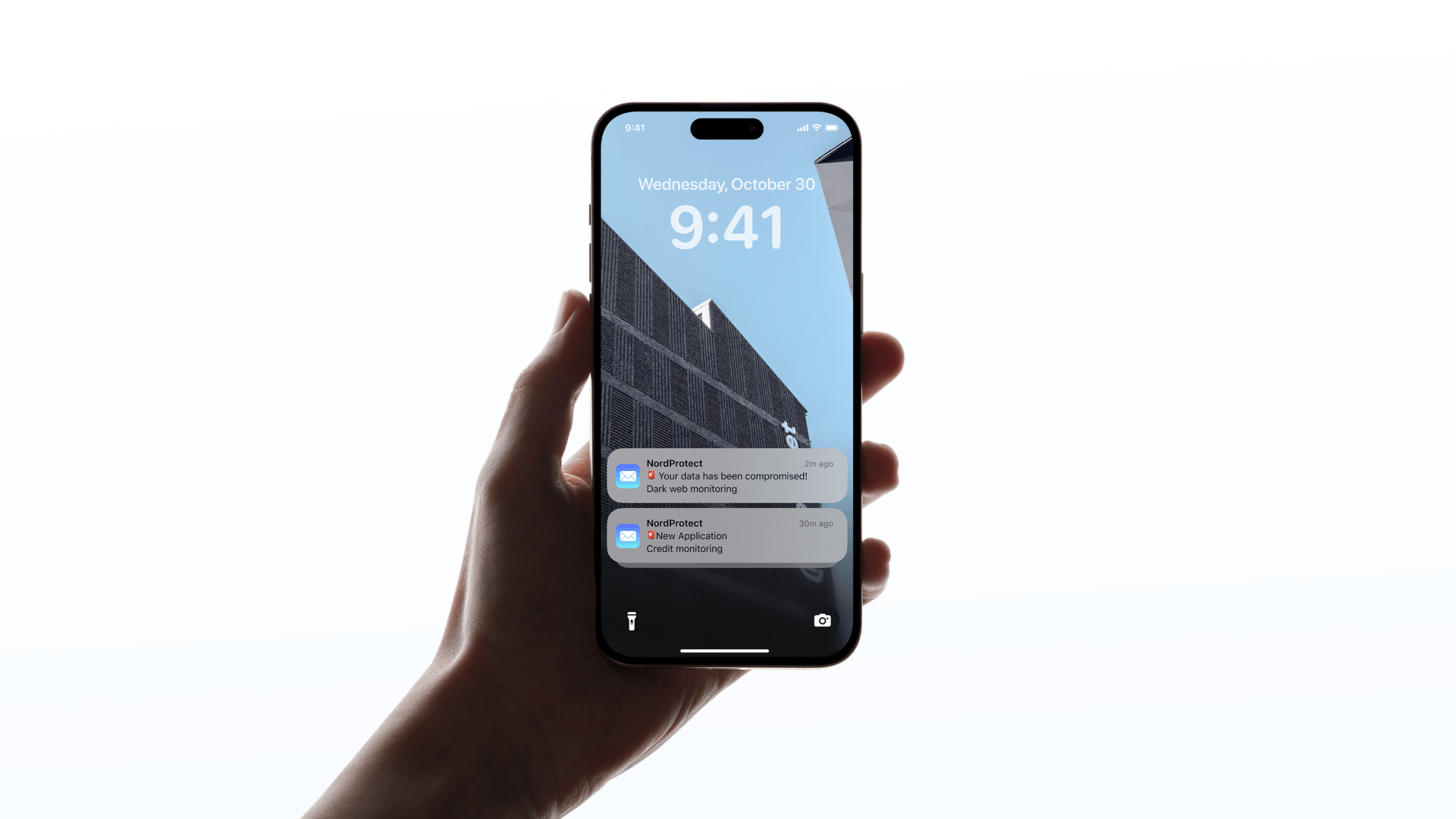

TOGETHER WITH NORDPROTECT*

Protect Your Money From Scammers ⛔️

You’ve probably heard a story like this: someone clicked a “security alert” text, thinking it was from their bank. By morning, new accounts were opened in their name and a quiet stream of withdrawals had already started. No drama, just expensive chaos and days on the phone.

Don’t wait for that wake-up call. NordProtect helps you stay ahead of identity theft and financial scams with real-time dark web and credit monitoring that flags suspicious activity fast. You’ll get near-instant alerts if something looks off. Like a shady credit inquiry or leaked personal info, so you can lock it down before it snowballs.

And if the worst happens, you’re covered with up to $1M in recovery support for eligible expenses, plus a dedicated 24/7 case manager to guide you through restoring accounts, disputing charges, and getting your life back. It’s a digital watchdog for your money, so you can enjoy it, not worry about losing it.

Protect your identity NOW! Get an exclusive NordProtect discount at https://nordprotect.com/howtomoney. It’s risk-free with a 30 - day money-back guarantee.

TECHNOLOGY

Are “Smart” Homes Really Smart? 💡

New homes are getting packed with technology that promises to make life easier. But lately? A lot of that “smart” tech feels… kind of dumb. Instead of simplifying daily life, some modern home tech adds friction, lag, and a whole lot of confusion.

The problem isn’t technology itself; it’s technology that tries too hard. When every basic task requires menus, screens, and guesswork, convenience evaporates. Meanwhile, old-school solutions like physical switches, clear buttons, and simple thermostats just work. No instructions required. No Wi-Fi necessary.

Not only is this annoying, but it could be eating into your budget for no good reason. Overbuilt tech often comes with:

Higher upfront costs.

Ongoing maintenance or subscription fees.

Shorter lifespans when software stops being supported.

Costly repairs for things that used to be simple.

Ironically, the “simpler” option is often the one that lasts longer and costs less.

When it comes to your home (and your budget), smarter doesn’t always mean newer. It means clearer, more reliable, and easier to live with. Before paying extra for the latest features, ask yourself: Will this actually make my life easier… or not?

Sometimes the best choice is the one that works with the flip of a switch. 💡

CARS

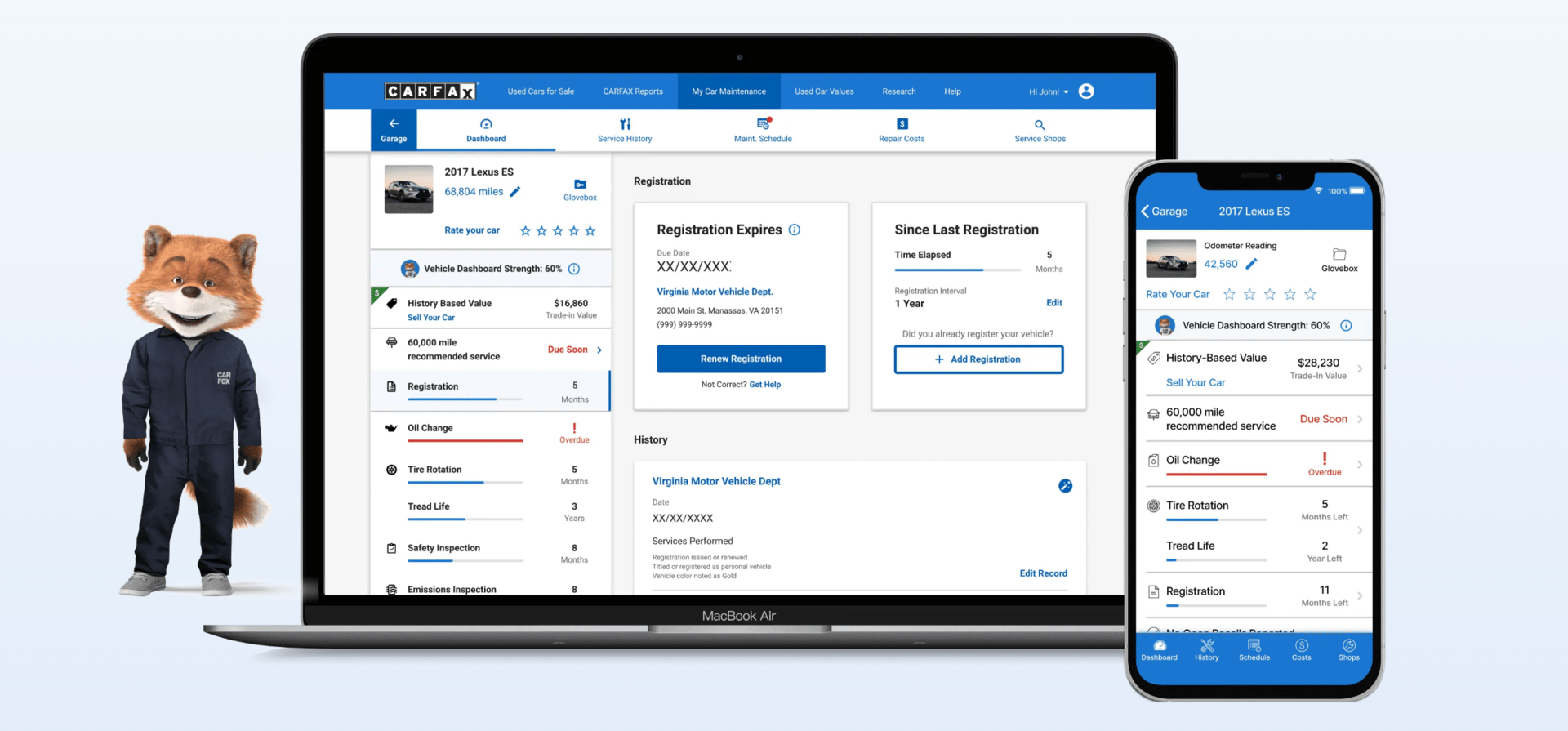

Your Car’s To-Do List ✍️

Car repairs have a sneaky way of getting expensive when you fail to keep up with routine maintenance. We recently discussed how it can be difficult to keep track of it all when one of our Facebook Group members offered up his personal solution.

He recommended the CARFAX Maintenance Tracker: a free tool that helps you stay on top of oil changes, inspections, tire rotations, and more.

It uses your car’s history to send reminders for upcoming service, so you don’t have to guess what’s due or dig through old paperwork. Staying consistent with maintenance doesn’t just keep your car running smoothly — it can help prevent bigger, pricier problems down the road.

A little prevention now can save you a lot later. Keeping your car in good shape is one of the simplest ways to protect your budget and avoid surprise expenses.

Want to get access to helpful tips from fellow pod listeners? Make sure you join the HTM Facebook Group here! (Thanks for sharing, Brian!)

ICYMI!

Your Weekly Update…

$20 for Your Troubles? 💸

Verizon is offering affected customers a $20 account credit after a widespread service outage knocked out calls and data, but you actually have to claim it yourself through the myVerizon app or customer service. Make sure you claim yours!

Collections On Hold 📚

Federal student-loan wage garnishments and tax refund seizures for defaulted borrowers have been temporarily paused while the Education Department works on new repayment reforms. That means defaulted borrowers get extra time before forced collections kick in, but credit reporting and interest may still apply.

Bonds (Not James) Starting Off Hot 🔥

Global bond sales just logged their busiest start to a year on record, with companies and governments rushing to borrow while investor demand stays strong. The surge hints at optimism in the markets, despite global uncertainty.

Less Snacking, More Saving 🍟

Households using popular weight-loss drugs cut food spending within months, especially on fast food and snack items. While we don’t recommend using these drugs unless deemed necessary by a medical professional, it’s an interesting stat!

Careers Come and Go 💼

This deep dive breaks down which jobs rose and fell across generations and why. The trends reveal how education, gender, and timing play a huge role in shaping opportunity.

Hope this made your soft re-entry a little smoother. Same time next week?

Best friends out! 🍻