- How To Money

- Posts

- Making More, Feeling Better, and Focusing on the Important Stuff! 🤝

Making More, Feeling Better, and Focusing on the Important Stuff! 🤝

From raises to groceries... practical money moves for this week.

Good morning, HTM Fam!

First and foremost — we want to say Happy Veterans Day! 🇺🇸

Today’s a reminder to pause and thank the people who’ve served — the ones who sacrificed so we can live, work, and build our futures in freedom. Whether it’s a friend, family member, or neighbor, take a moment to reach out and show your appreciation.

NEGOTIATION

How to Ask For More Money 💬

Talking about money can feel awkward — but not asking can quietly cost you thousands.

Negotiation isn’t about being pushy or ungrateful. It’s about making sure your pay keeps pace with your value. A small gap in salary at the start of your career doesn’t stay small — it compounds. Every annual raise, bonus, etc. is usually a percentage of your current salary. The lower you start, the smaller each jump and bonus will be.

The key? Keep emotion at bay. You’re not pleading your case — you’re presenting one. Lead with results, not feelings. Make sure you come prepared to any negotiation with:

📈 Proof of impact: Show what you’ve achieved; revenue you’ve generated, projects you’ve dramatically improved, or goals you’ve exceeded.

🧐 Market research: Bring data on what similar roles are paying in your industry or region.

🗣️ A clear ask: Know the number (or range) you’re aiming for, and be ready to explain why it’s fair.

💪 Confidence and composure: State your case, and know why you believe you deserve it. If you don’t think it’s within reason, neither will your employer.

Remember, negotiation isn’t just appropriate when starting a new job. Annual reviews, big wins, or new responsibilities are all great moments to address your pay.

Because when you ask for more, you’re not just earning more — you’re building margin into your life. That extra cushion can go toward paying off debt faster, investing for the future, or simply buying back a little peace of mind.

Bottom line: it never hurts to ask. The best investment you can make might start with one confident conversation. 🤝

LIFESTYLE

Making Money That Feels Good 💰

Money can buy comfort — but it won’t buy happiness if your life revolves around chasing status.

The real boost in well-being comes when money is a tool, not a trophy: use it for security, for the people you love, and for more free time — not to one-up your neighbor or as an attempt to increase your self-worth.

Here are a few small shifts that can help your money add more meaning to your life:

Start with the “why.” ❓

When you want more money, ask yourself why. Is it for security and freedom — or attention and status? The first builds peace of mind; the second just moves the goal post further away.

Dial down the flex. 📉

Just because you can buy the newest car, watch, or phone doesn’t mean you should. Choosing a model or two behind can save you a ton — and free up cash for things that actually add value to your life.

Spend quietly, together. 👭

Experiences with people you care about reliably increase happiness. The key is to make sure you’re present in the moment, and not just doing something to post about it on social media.

Give a little. 🫴

Generosity goes a long way. Donating to causes you care about — whether that be your time or your money — tends to boost happiness more than another “treat yourself” purchase. (which reminds me, join us in our Voices For Good challenge!)

When you stop spending to keep up, you make space for saving, investing, or tackling debt. And those moves open real doors: time to rest, room to grow, and less financial pressure. That’s the kind of wealth that truly matters.

TOGETHER WITH CIT*

Give Your Money a Raise 💰

Your money called — it wants a better job.

CIT Bank’s Platinum Savings account pays 3.85% APY on balances over $5,000, with no monthly fees or hidden strings. Use promo code PS2025 and you could earn up to $300 in bonus cash.

Deposit $25,000 to get $225, or $50,000 to get the full $300. If your cash is sitting in a lazy account, this is your cue to give it a promotion. 🚀

ECONOMY

Grocery Prices are Still a Mixed Bag 🍎

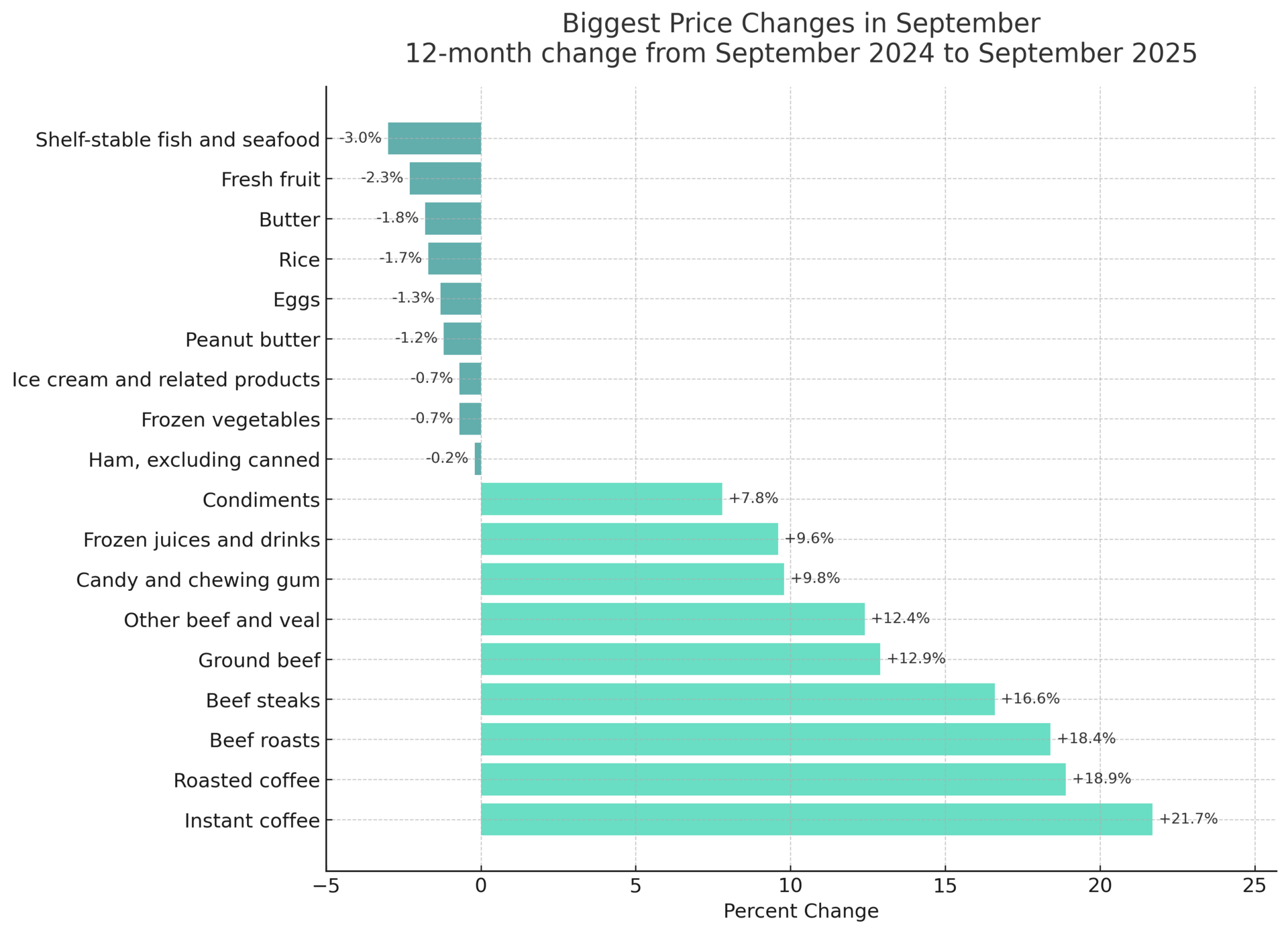

Some relief has hit the grocery aisles — shelf-stable fish and seafood are down 3%, and fresh fruit dropped 2.3%. But don’t celebrate just yet: coffee lovers are feeling the sting, with instant coffee up more than 21% and roasted coffee not far behind at +18.9%. Beef prices are also climbing, with ground beef up nearly 13% year over year.

Groceries are always going to be a significant line item in your budget, especially if you’re shopping for a family. While we can’t control which items increase or decrease in price, we can control what we buy and where we buy it to save a bit of cash.

Here are a few ways to stretch your grocery budget a little further:

Plan your meals. 🍝

Grocery prices are all over the place right now, which makes planning ahead more important than ever. Start with a meal plan and a list, and actually stick to it. You’ll spend less, waste less, and avoid those “how did my total get that high?” moments.

Consider “Meatless Mondays” or opt for different meats. 🥩

Going meatless once or twice a week will not only help your wallet, but also the planet. If cutting back completely isn’t for you, try opting for more affordable cuts and trimming or deboning them yourself instead of paying the markup for prepped meats. A little effort can make a big difference.

Shop the stores that make sense. 🛒

Budget-friendly stores like Aldi, Lidl, or warehouse clubs often carry the same (or nearly identical) products as bigger-name grocers, but for a fraction of the price. If you’re willing to swap your usual brands or skip the fancy packaging, you can likely save 20–30% on a full grocery run without sacrificing quality.

Don’t Sweat the Small Stuff 💦

We’ve all been there — standing in the grocery aisle debating which paper towels are the better deal, then turning around and putting off a big financial decision for weeks. That’s what scientist Edward Fredkin called the “paradox of smart decisions.” In short: we overthink the small stuff and avoid the things that actually matter.

Fredkin found that people tend to spend the most time on decisions that make the least difference, like choosing between two nearly identical investments or chasing a slightly higher interest rate, while procrastinating on bigger ones that will truly move the needle. It’s not that we don’t care; it’s that big financial questions can feel overwhelming.

The fix? Focus your energy where it counts. You don’t need to analyze every fund or fee down to the decimal. Pick a good option, move on, and use that time to check in on the things that will meaningfully improve your financial health.

Here are a few areas worth your attention as we close out the year:

Health insurance: With open enrollment season here, take time to review your plan thoroughly. The right coverage can save you thousands in medical bills.

Mortgage and loan rates: When taking out a mortgage, if you shop with at least 3 lenders, you’re likely to save thousands of dollars. And if your mortgage is above 6.5%, consider refinancing. Even a 1% rate drop can mean big savings… just make sure the cost of refinancing is worth it.

Retirement accounts: Fill them up if possible! Max out your 401(k) or Roth IRA if you can. If you’re self-employed, get that solo 401(k) going.

Tax-advantaged accounts: Don’t overlook HSAs or FSAs — they can reduce your taxable income and help cover health costs.

Withdrawal strategy: For retirees, consider strategic IRA withdrawals or Roth conversions before required minimum distributions kick in.

Insurance check-up: First, shop around. Also, review your home and auto coverage: liability limits, umbrella coverage, and discounts for things like good grades or annual payments can make a difference.

Property taxes: You can appeal your home’s tax assessment if it’s out of line with comparable properties. If you want to make it easy, try using Ownwell.

Beneficiaries: Double-check who’s listed on your retirement accounts and insurance policies. It’s easy to forget, but it only takes a few seconds, and it’s crucial to ensure your loved ones are taken care of.

Estate planning: Make sure your will and estate documents match your current life situation, especially if you’ve moved or your state’s tax laws have changed.

The bottom line: don’t let the small stuff steal your focus. A few smart, high-impact moves can make a bigger difference than hours of overanalyzing minor choices. Take your time on the decisions that shape your long-term security and let the rest go. 👋

ICYMI

Your Weekly Update…

Burrito Blues 🌯

Chipotle’s stock just got wrapped up in a 19% drop — their slowing sales show how higher prices can keep even loyal customers away. Let this serve as a reminder to watch the “little extras” in your budget that quietly eat into your bottom line.

The Sky Isn’t Falling ☁️

Layoffs might sound like bad news, but the job market is still flexing its strength. Even with cuts at Amazon and UPS, most industries are hiring steadily — proving that a few headlines don’t tell the whole story.

Howl-oween Spending 🐶 🎃

Americans dropped $860 million on costumes for their furry friends, a record that says a lot about our wallets, and even more about our priorities. When it comes to pets, “fiscal responsibility” seems to have its limits for many Americans.

Whether it’s asking for that raise, refinancing your mortgage, or just making a smarter grocery list — the small things add up. Keep showing up, keep asking, and keep building a life that feels good (not just looks good). You’ve got this. 👏