- How To Money

- Posts

- Larger Limits, Bigger Questions, and Embracing the Boring! 🥱

Larger Limits, Bigger Questions, and Embracing the Boring! 🥱

This year, we're able to contribute even more to our Roth IRAs. Do you have a plan to max yours out?

Good Morning, and Happy New Year!

Watch out, the gym is likely to be packed for the next 2-3 weeks. Personal finance content also experiences a New Year’s boost.

But in both cases, interest wanes by February. Whatever your goals may be this year, don’t be like the hordes of people who quickly fall off the wagon; make a realistic plan and incorporate small changes so you can stick with it over the long haul.

RETIREMENT

Bigger Limits in 2026 💰

The IRS just gave future you a raise. For 2026, Roth IRA contribution limits are going up:

$7,500 max for investors under 50 (up from $7,000)

$8,600 max if you’re 50 or older (thanks to catch-up contributions)

Why Roth IRAs Are Worth Prioritizing 🎯

Roth IRAs are our favorite for a reason. You pay taxes now, but your money grows tax-free, and qualified withdrawals in retirement are 100% tax-free. That tax flexibility can be a game-changer later on.

Income Limits to Know for 2026 📈

Your ability to contribute depends on your income:

🧍♂️ Single filers:

Full contribution under $153,000

Partial contribution up to $168,000

👫 Married filing jointly:

Full contribution under $242,000

Partial contribution up to $252,000

If you’re above these limits, you’re not out of luck. There’s always the option of a backdoor Roth IRA if you would like to get the tax-paying out of the way now so you can amass tax-free dollars for your future.

BUT, contributing to a Roth IRA isn’t the same as investing in it. When you deposit money, it often lands in a settlement fund or cash account by default. If you leave it there, you’re missing out on growth. It’s crucial to invest the money you’re putting into your Roth, so your money can grow.

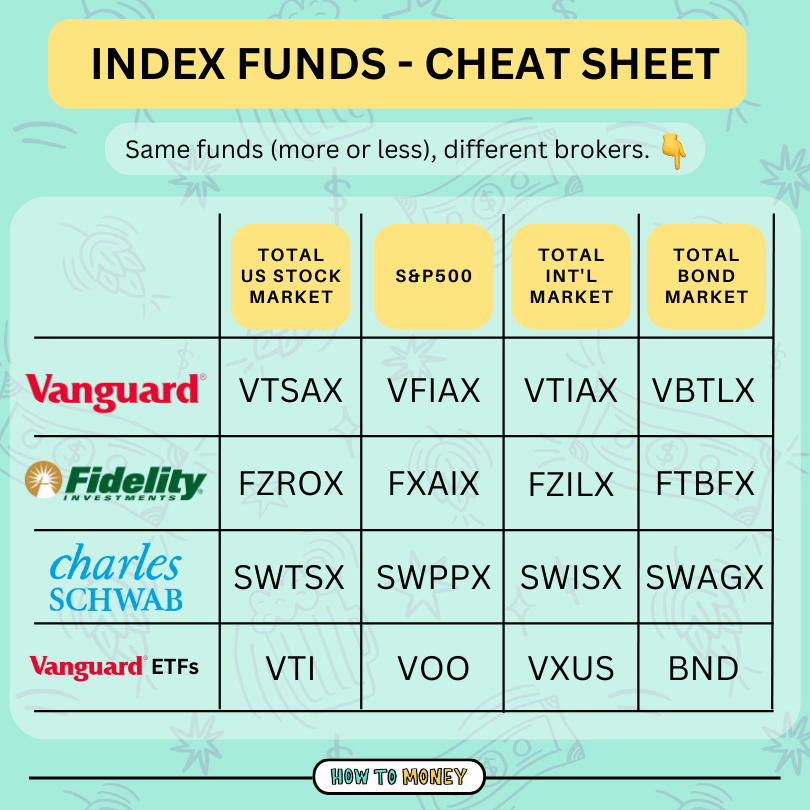

Don’t know what to invest in? We always recommend low-cost index funds or ETFs. That’s because they are well diversified, and the fees are minimal. See below for some of the investments we recommend, depending on your brokerage.

Remember: time in the market beats timing the market. The sooner you start contributing, the more time your money has to compound. Don’t wait for “perfect” timing. Start when you can and let time do the heavy lifting. 🏋️♀️

LIFESTYLE

The Cost of Convenience 🥡

Food delivery costs have climbed fast, and yet, Americans aren’t pulling back. Studies show that ordering delivery can cost nearly twice as much as picking up the same meal yourself once you factor in higher menu prices, service fees, taxes, and tips.

What’s driving it? A mix of rising labor costs, inflation, and increased competition among delivery drivers (who often prioritize higher-paying orders). Restaurants also tend to charge more for delivery orders to offset app fees. But the biggest reason we keep paying? Time.

Many of us feel “time-poor.” Between work, family, and packed schedules, delivery offers convenience, comfort, and a way to reclaim a few precious minutes. Pandemic habits stuck, working from home changed how we eat, and ordering in now feels just as normal as dining out.

While food delivery isn’t “bad,” it is a premium service. You may not be able to re-create your favorite Thai restaurant at home, but you can at least pick it up yourself on the way home! Being mindful about how often you opt for delivery can help you enjoy the convenience without letting it eat away at your budget.

TOGETHER WITH US MOBILE*

A Phone Plan that Works for You 📱

Ready to cut your phone bill without losing bars or perks? US Mobile lets you pick a plan that actually fits your life, from budget-friendly basics to unlimited data, talk & text… all with no hidden fees.

And the best part? You get 30 days free to see if it works for you. Add in easy setup, great coverage, and even streaming perks on select plans, and switching feels like a no-brainer. 🧠

PERSONAL FINANCE

Asking the Big Money Questions 🤔

Being frugal isn’t unimportant, but sometimes you need to stop sweating the small stuff and focus on the big wins. Instead of agonizing over a $3 coffee or the extra dollar on spaghetti sauce, ask yourself the $30,000 questions… the decisions that really move the needle on your wealth.

Some examples of these big wins:

Investment fees: Paying 1% AUM to an advisor could cost tens, or hundreds, of thousands over a lifetime. Investing in low-cost index funds can put that money back in your pocket!

Salary negotiation: Even a single $5,000 raise early in your career can compound into hundreds of thousands more. Just make sure you’re well prepared on why you should get a raise before you ask!

Conscious spending & SMART goals: Automate your savings, invest consistently, and spend on the things that truly matter. Setting SMART goals is an underrated way to help you actually achieve the things you want in 2026.

Focus on big wins that create real financial impact, and don’t get trapped in tiny, stress-inducing decisions (like saving a dollar or two here and there).

This doesn’t mean you shouldn’t care about smaller spending habits. Small savings can still help create breathing room, and a little breathing room each month can go a long way. But if you’re going to put the time and effort into saving a dollar on a loaf of bread, you should put even more into the big decisions. 🙇

LIFESTYLE

When Money Tips Get Murky 📱

Social media is full of financial advice, and young adults are listening. In fact, 61% of investors under 35 turn to influencers on TikTok, YouTube, or Instagram for tips. Sounds convenient, right? But much of that advice isn’t regulated, may be oversimplified, and can even be self-serving.

A few things to keep in mind before following the latest trend:

🎓 Qualifications matter: Know who you’re listening to. Unlike licensed financial advisors, influencers aren’t held to fiduciary standards.

💸 It may be paid content: Sponsorships, affiliate links, and hidden commissions can lead to biased advice that’s hard to spot.

🔓 Simplified doesn’t mean safe: Complex strategies are often condensed into viral videos that gloss over risk.

⚠️ Scams exist: Pump-and-dump schemes and hype-driven investments prey on fear and FOMO, especially in an age of crypto and gold rallies.

Social media can inspire ideas, but it shouldn’t replace thoughtful, informed investing. The tried and true ways of investing are just that… tried and true. There’s a reason why you don’t get hype videos about buying S&P 500 ETFs: practical investing is boring. 🥱

And it should be! Safe, consistent investing is your best bet to creating financial independence. Let’s not overcomplicate it.

ICYMI

Your Weekly Update…

Santa Rally Rolls On 🎅

The markets closed 2025 on a high note, with the S&P 500, Dow, and Nasdaq hovering near all-time highs as the “Santa Rally” kicked in. Strategists are optimistic about 2026, but warn investors to stay cautious. (🎧 Investing is Risky. Do it Anyway)

Sip Less, Save More 🍸

Skipping alcohol for a month isn’t just good for your health, it’s good for your wallet too. Dry January may just be a popular trend, but it has real benefits. Consider giving it a shot this year and seeing how much you can save!

Early Risers, Big Wins ☀️

Successful women reveal that mornings aren’t about perfection; they’re about intentional routines. From workouts and sauna sessions to kid dance parties and mindfulness, here’s some inspiration on how you can start your day off right.

We hope everyone enjoyed ringing in the New Year, and we look forward to all the wins we’ll see from HTM listeners and readers in 2026! 🏆