- How To Money

- Posts

- Insurance Secrets, Modern Day Gold Rush, and a $102 Million Heist! 💎

Insurance Secrets, Modern Day Gold Rush, and a $102 Million Heist! 💎

We may not have been in your inbox, but we haven’t been living under a rock.

Drum roll, please… 🥁🥁

The boys are back!

We appreciate everyone who has reached out, wondering where our infamous Tuesday-morning newsletter has gone, and we’re excited to be back!

We may not have been in your inbox, but we haven’t been living under a rock. We’ve got a lot to cover! But first…

NATIONAL NEWS

It’s election day!

Today’s your chance to help shape the economy, your community, and the world you live (and work) in. The people in power don’t have as much influence over your life as you do, but their impact spans the financial markets to Main Street.

So if you haven’t already, make sure you hit the polls and make your voice count. 🗳️

INSURANCE

Let’s talk car insurance!

Do you know everything that goes into your car insurance premium? Unfortunately, a squeaky-clean driving record doesn’t mean you’re off the hook. 🧽🚗

A big component of the insurance premium quote you get is the make and model of your car. Typically, people think the newer, fancier cars will cost more to insure. And while this is often true, it’s not the whole truth. There’s a lot more that goes into the equation. So what are these insurance companies looking at?

The Age of Your Vehicle — Cars are the most common depreciating asset people own, and the older your car is, the more its value will depreciate (unless you’re driving a classic car, that is). The more that value goes down, the less your insurance company will have to fork over if your car gets totaled.

Your Vehicle’s Safety Rating — No surprise here; the safer your car is rated, the less likely it is to injure its occupants in the event of a collision! That leads to less money the insurance company has to pay out in the event of an accident. Driving a car with better safety ratings is good for your peace of mind and your finances. 💵

The Fancy Bits — Having a unique car may be fun, but it will cost you. Things like luxury trims, convertible tops, and innovative technology features are all factors that can jack up the price of your insurance. Why? This makes your car’s parts harder (and more expensive!) to replace. Basic models are cheaper to buy and, on average, less expensive to insure.

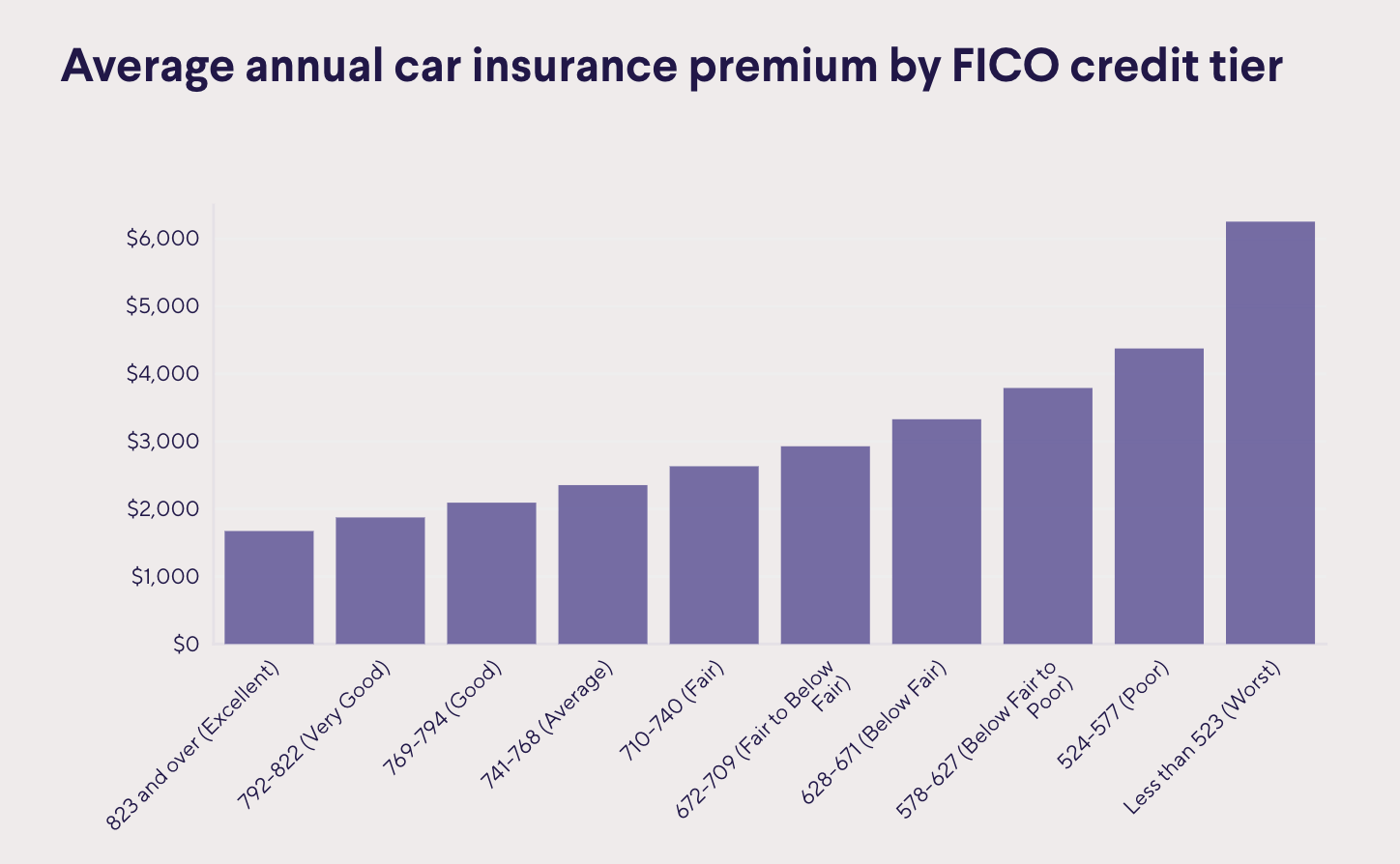

Your Credit Score — You heard that right! Your financial habits impact all areas of your life, including your insurance premiums. Insurance companies use a credit-based insurance score, which ranks you on how likely you are to file a claim. The better your credit score → the less likely you are to file a claim → the better your insurance score → the lower your premium. Catch all that?

Key Takeaways 💡:

Age isn’t just a number! 🎂 The older the vehicle, the lower its value — and usually, the lower your premium.

Safety pays off. 🔒 Cars with high safety ratings can save you money because they’re less likely to cause injuries (or big payouts for your insurer). Check your car’s safety rating here.

Luxury = higher costs. 📈 Those extra bells and whistles may look nice, but they’re pricey to repair and replace, and your premium reflects that.

Credit counts. 💳 A strong credit score can mean a lower insurance rate as it signals you’re less likely to file claims. Check this article out if you want to increase your score.

ECONOMY

Modern-day gold rush? 💰

Step aside, Apple, this season’s hottest commodity isn’t sleek, shiny tech... It’s actual shiny metal. ✨

That’s right: gold fever is back, and it’s spreading.

On October 7th, gold futures blew records and minds by soaring past $4,000 per ounce for the first time ever. And since then? Prices have kept climbing, fueled by global uncertainty, inflation concerns, and a growing desire for “safe haven” assets.

But just as gold hit new heights, it did what markets tend to always do… it came right back down, sliding more than 6% in a single day.

Don’t get us wrong — gold’s been on a wild run these past two years, and it’s earned its spot as a strong long-term play. Still, when you see any asset shooting up like a rocket, remember: what goes up fast usually corrects quickly. And that might be exactly what we’re watching unfold now.

So the question on everyone’s mind: will gold go back up, rising to new heights?

Unfortunately, we don’t have that crystal ball (if only!) 🔮

But should you “buy the dip” and start lining up for a few gold bars of your own?

Probably not. There are smarter (and lighter) ways to get in on the action than picking up a gold bar the next time you hit up Costco. Instead of stocking up on physical bars and encountering the problems that come with storing them, dip your toe in by investing in a Gold ETF instead, like $GLD ( ▲ 3.64% ), which tracks the price of gold without the hassle of storage or security.

Still, investing in gold isn’t right for everyone. Gold has had extended periods (think multiple decades) where the price declined and investors lost money. Despite all the hype, think twice before investing.

It’s important to note that much of gold’s climb has occurred this year, and this is not us telling you to treat $GLD as a surefire investment. We still prefer index funds such as VOO or VTI for long-term investors.

TOGETHER WITH CIT*

Give Your Money a Raise 💰

If you’ve got a pile of cash sitting in a low-rate account, it might be time to give your money a raise.

CIT Bank’s Platinum Savings account pays 3.85% APY on balances over $5,000 — no monthly fees, no nonsense. Not only is this one of the best rates on the market, but right now, with the promo code PS2025, you can earn a bonus of up to $300 by moving your money somewhere it actually works for you.

You’ll have to deposit at least $25,000 to earn $225, or $50,000 to earn the full $300. But if you already have that money sitting in a lower-interest account, this is even more of an incentive to move your cash over to CIT.

If you’ve been thinking about making a switch — now’s the time! ⏳

DID YOU HEAR?

Reinventing the wheel? 🛞

Netflix is teaming up with Spotify to roll out a curated lineup of video podcasts on its platform beginning in early 2026.

Yes, you heard that right… video podcasts. Some of us may call that TV, but what do we know? 📺

The new partnership means you’ll soon be able to watch your favorite shows instead of just listening, proving once again that even if you think everything has been invented or created already, there’s a new way of doing something old!

In all seriousness, it’s a chance for Spotify to tap into a new audience while Netflix broadens its content lineup. It’s also a chance for us as consumers to take a step back and scroll through our own subscriptions, making sure we’re regularly cancelling those we don’t use and putting that money back in our pockets.

Who knows… maybe you’ll see our faces on the big (medium?) screen one day. 😜

Louvre Suspects Arrested 👑

A heist fit for Hollywood — and a price tag to match. French authorities have arrested two suspects (not Matt and Joel) tied to the theft of crown jewels valued at €88 million ($102 million) from the Louvre in a mere eight minutes.

Incredible planning, terrifying audacity, and completely illegal, of course. One suspect was caught at the airport attempting to flee to Algeria, while DNA traces led to the other’s capture.

No word yet on whether the treasures have been recovered, but the world’s watching closely as Paris investigators sift through clues. I think it goes without saying that we wouldn’t recommend partaking in any heists as a “get-rich-quick” scheme.

We’ll stick to saving and investing, thanks. 💸

ICYMI

Your Weekly Update…

2026 ACA Premium Tax Credits 🩺

Big headlines, but small truths. ACA Premium Tax Credits aren’t going away in 2026, but they are changing. Early retirees, now’s the time to plan smart, not panic. Here’s what to know before open enrollment kicks off.

Full-Court Scandal? 🏀

NBA coach Chauncey Billups and player Terry Rozier are among 34 linked to organized crime. Millions were allegedly at stake, insider info was used, and now the league is scrambling — talk about high-stakes drama.

This serves as a quick reminder that sports betting is always a gamble — you never know what’s influencing the game!

Where Have All the Teen Jobs Gone? 💼

Remember your first summer job? Turns out teens today are missing out — just 35% worked last year. Beyond cash, those early jobs teach real-world skills that pay off for years to come. Maybe it’s time to bring back the teen hustle.

Thanks for sticking with us — we’re back in your inbox and ready to keep you up to speed. Until next week! 👋