- How To Money

- Posts

- Ditching Door Dash, Budgeting Rehab, and a Very Merry Unbirthday To You 🎂

Ditching Door Dash, Budgeting Rehab, and a Very Merry Unbirthday To You 🎂

Good morning, and a very merry unbirthday to you (Unless of course, it is your birthday🤪)!

Good morning, and a very merry unbirthday to you (Unless of course, it is your birthday🤪)!

Although I’m not personally a big Alice in Wonderland fan (the Cheshire Cat and Caterpillar are MAJORLY creepy), there is something to be said about celebrating even the most mundane days.

Life is precious, and we only get a limited amount of time on this Earth. So find a small way to make today special- even if it’s just a regular ol’ Tuesday!

On to the money! 🤑🤑🤑

TO DO

Delete Your DoorDash/Uber Eats Apps 🚗

There are certain treats I just can’t keep in my house. Ben and Jerry’s salted caramel core ice cream is one of them. It doesn’t matter how healthy I’ve been eating, if its in my freezer, I’m taking it down in one sitting.

For similar reasons, I choose not to keep food delivery apps on my phone! If the app is a swipe away, the temptation is there, and I’m way more likely to give in and place that over-priced order for pad thai.

It’s no secret Americans spend a ton on food delivery services. In fact, according to Empower, it’s among the top non-essential splurges, with folks spending an average of $118 on food delivery apps monthly.

Our challenge to you this week is to delete these apps from your phone. If you want to splurge and order some food, you’ll have to redownload your delivery app or pull out your computer. It may sound silly, but adding that little bit of friction to the purchase process can help you to make more financially savvy decisions on a daily basis.

SAVING MONEY

Do You Need Budget Rehab? 👀

Budgeting. It’s both super important, and super unpopular.

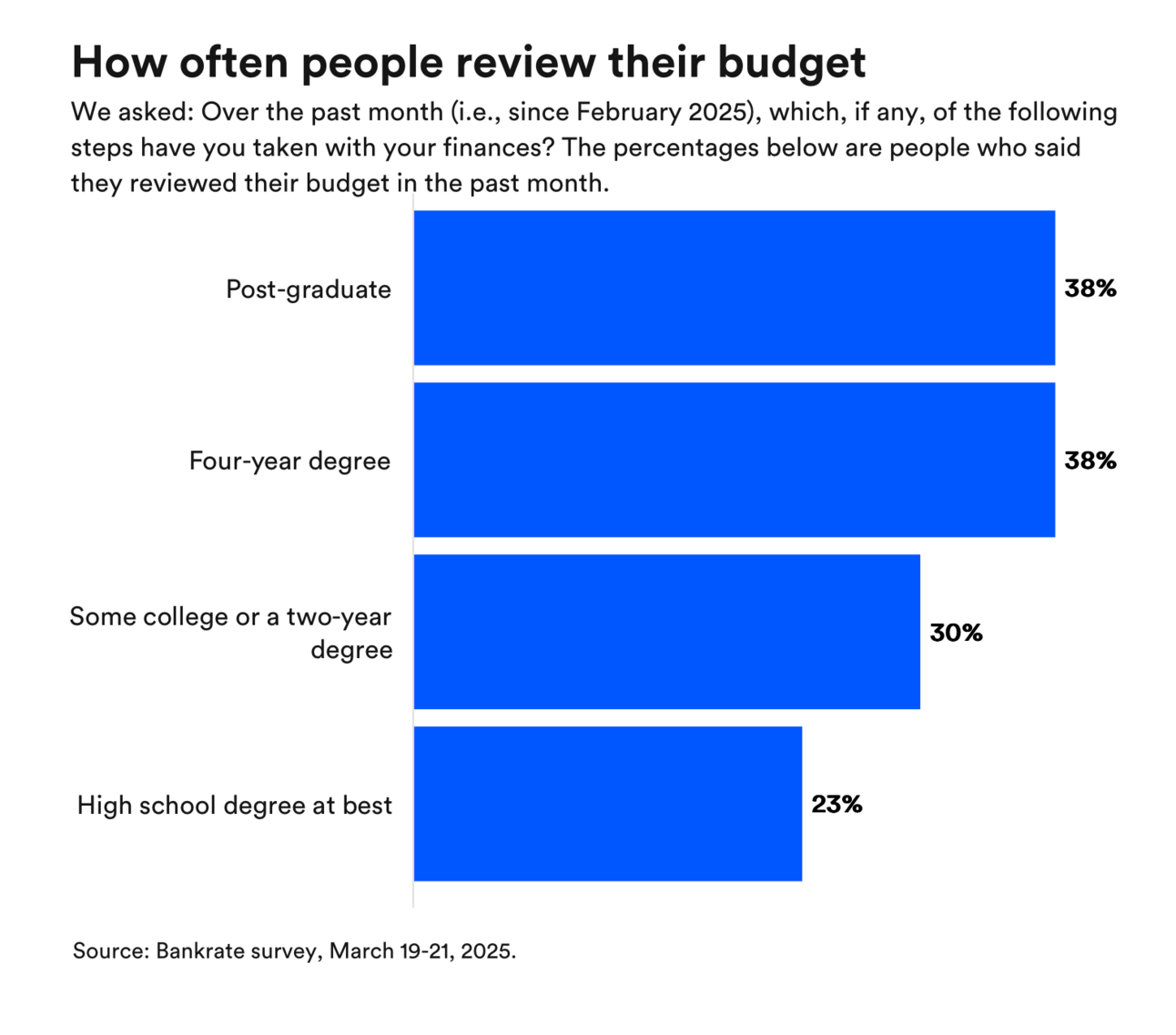

While frugal folks know that budgeting is key when it comes to saving money and growing wealth for the future, it’s not uncommon to find the task of keeping up with it daunting. In fact, a recent Bankrate survey found that less than one third of Americans checked their budget over a 30-day period!

Tracking every expense may not sound like everyone’s idea of a good time, but it shouldn’t feel like pulling teeth either! If you’re struggling to manage and stick to your budget, then your budget ain’t working. It’s not me, it’s not you. It’s your budget. 🤷♀️

Keeping up with the right budget for you shouldn’t feel like a burden. But, it takes some trial and error to land on the budgeting systems that work best for you.

Budget Rehab: How to Fix a Failing Budget

Unlike your sucky ex, you can totally fix your budget. If it’s not working for you month after month, try one of these tips to transform your budget into the perfect money saving partner!

Set Realistic Goals - Probably the most common reason why budgets fail is that many folks set unrealistic spending goals. When you overly restrict your spending, you’re setting yourself up for failure. Try tracking your spending for a month, then budget for the following month based on those numbers. By reducing your spending slowly over time, you’re more likely to adjust seamlessly to those changes in lifestyle.

Look at your Calendar while Budgeting - When budgeting, it can be helpful to use your calendar as a tool to better plan out your month. This way, you won’t forget to budget for that wedding or night out with your friends.

Create a Slush Fund - Don’t let unexpected expenses pop up and break your budget! It’s impossible to plan for everything. Life happens. So create a “catch all” slush fund in your budget to cover those small expenses that are difficult to plan for. That way, you won’t have to constantly reallocate funds from another spending category.

Switch Up Your Budgeting Method - Everyone’s perfect budget is going to look a little bit different. One particular budgeting method may work better for you. So, if you’re struggling to stick to a budget, consider trying out a new budgeting method, like the 50/30/20 budget, or a zero-based budget.

Have a “Just For You” Fund - If you’re budgeting with a partner, it’s important that you both have a little spending money to put towards your hobbies and favorite “craft beer equivalents.” This can help to avoid money arguments, and keep you from needing to run every little purchase by the other person.

Tie Your Budget to More Meaningful Goals - It’s easy to get lost in the drudgery of numbers and spreadsheets, but the truth is that budgets exist to help you accomplish your biggest money goals. We often need to remind ourselves of those dreams to give us the motivation to stick to our budgets. Consider listing your big goals at the top of your budget, or even making it the screensaver on your phone so that you never lose sight of the bigger picture.

Get an app involved - Sometimes, ye’ old pencil and paper budgets just don’t cut it. If you’re struggling to stick to a budget, using an app like YNAB could boost your budgeting skills since it links to your accounts and will automatically track your spending. While YNAB will cost you money, the average user saves $6,000 in their first year.

When your budget gets blown, don’t spend time beating yourself up over it. Instead, get right back on the horse and rework it. It can take a few months, or even years of tweaking your budget to find the perfect solution. Don’t give up! The money saving benefits will be well worth the hard work. 💪

Related Content:

TOGETHER WITH US MOBILE*

Buy with Confidence 📲

US Mobile lets you try out their coverage and service for free for 30 days to see if they’re a good fit for you…

With no contracts, there’s nothing to lose by giving them a try! With the cheapest unlimited plans available, starting at just $17.50 per month, a switch to US Mobile is well worth considering.

If you own your phone and want to slash your phone bill, check out US Mobile. 💪

ICYMI

In the News…

Digital Nomad Regrets 😩

Working while abroad has its charms, but many folks are finding that the admin associated with living a digital nomad lifestyle can be exhausting and isolating.

Investing in America 🇺🇸

In Callie Cox’s recent newsletter, she discusses why even in economically and politically turbulent times, heavily investing in American assets is still a good idea. In fact, the U.S. accounts for 27% of the global economy with just 4% of the population!

Unclaimed Funds Chaos 💰

A lawsuit has been filed against Ohio state officials who plan to seize unclaimed funds to provide a multi-million dollar grant to create a new pro football stadium.

P.S. - Approximately 1 in 7 folks are entitled to the over $7B of unclaimed money out there. Make sure to check and see if YOU have any unclaimed funds here.

Gen Z Super Savers 💵

Contrary to popular opinion, the youth are doing pretty well on the investing front. Gen Z started investing at a much earlier age than millennials. And young Gen Z women are even more diligent about saving for retirement.

Buy Now, Pay Never 😬

Klarna, a popular BNPL service, has reported that net losses have doubled in the first quarter of 2025 as borrowers struggle to pay back their loans. Remember folks, even though these services seem convenient, stay away from BNPL. It encourages you to spend money you don’t currently have, which is never a good idea.

Money chat over friends. Let’s get out there and crush this week ahead. 💪😤

Best friends out 🍻